You could also work out what the difference might be to the total interest you pay and your monthly repayments if you altered the term of the loan. It’s good to keep in mind that the calculator will only give an estimate of repayments on the interest rate stated, and does not take into account fees or changes in interest rates over time. Then, you could compare rates (such as via Canstar’s home loan comparison tables), and enter the details of your preferred alternative home loan offering, and compare the results. You could use it to enter the rates, term and amount of your current home loan, and then note down the result. One way to check if a new loan would help you to save compared to your current one could be to use a mortgage calculator. Home loan interest rates are regularly changing, so it could pay to shop around to find the best deal. As a hypothetical example, if one lender was offering an attractive interest rate but on a longer-term loan, you could use the calculator to work out if that was a better deal than another lender offering the same interest rate but a shorter term. If you already have a household budget sorted, know how much you can spend each month on a mortgage and know how much you want to borrow, this calculator could help you decide what loan conditions might suit your circumstances. This could also help you to decide what type of property you can afford to buy, and where.

If you are trying to decide how much you might be able to afford to borrow, you could use a mortgage calculator to work out how much your monthly repayments could be on different loan amounts. Keeping in mind that these types of calculators typically only give general estimates, here’s how one could be used in different scenarios: Buying a house Mortgage calculators and home loan repayments calculators can be handy tools to use when trying to estimate how much you will need to pay each month to cover your mortgage. Consider whether you need financial advice from a qualified adviser. Interest rates and other costs can change over time, affecting the total cost of the loan.

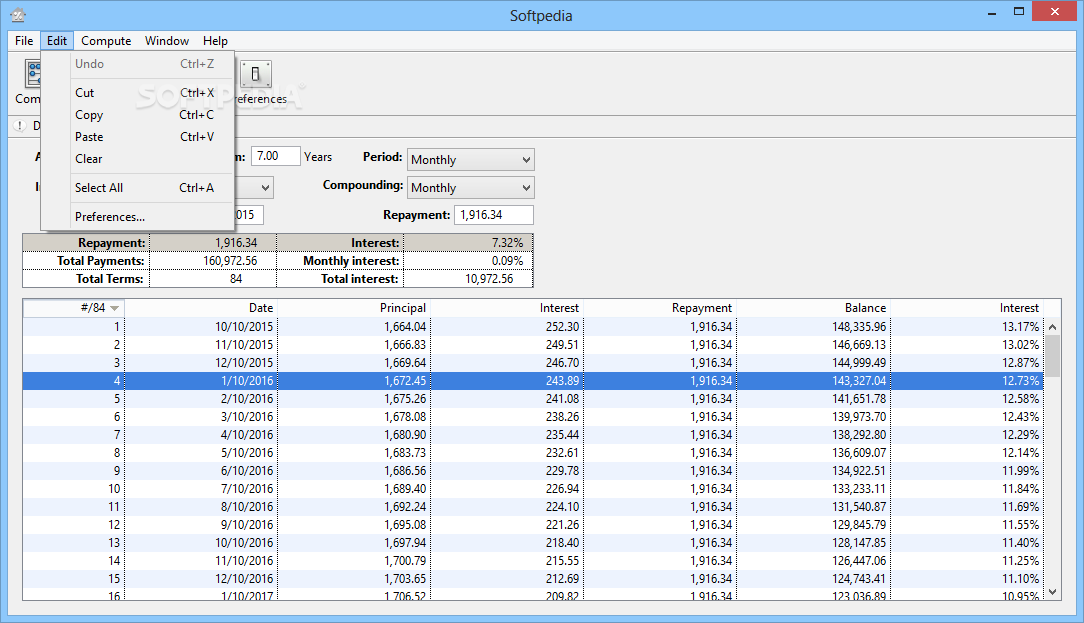

The results provided by this calculator are an estimate only, and should not be relied on for the purpose of making a decision in relation to a loan. Please note: The calculations do not take into account any fees you may be charged. You can display these results as a graph or a table, showing your total loan cost, as well as how long it will take to pay off the principal (if you choose this type of loan). The calculator will show estimated monthly repayments based on the information that you have entered, as well as the total estimated amount of interest that you would pay should you reach the end of your loan term (and the interest rate remains the same).

0 kommentar(er)

0 kommentar(er)