Here are the features of this cash flow excel template daily: The most important thing is that this template does not require any special skills or knowledge about accounting software, so even if you are not an expert accountant, getting this done would not be difficult at all!Ĭool Features of Cash Flow Excel Template Daily In addition, this template also allows you to make sure that the expenditures made are within your budget plan for the month/year. This template will help you to make better business decisions, as it enables you to understand how much money has been spent on any particular project or activity that day.

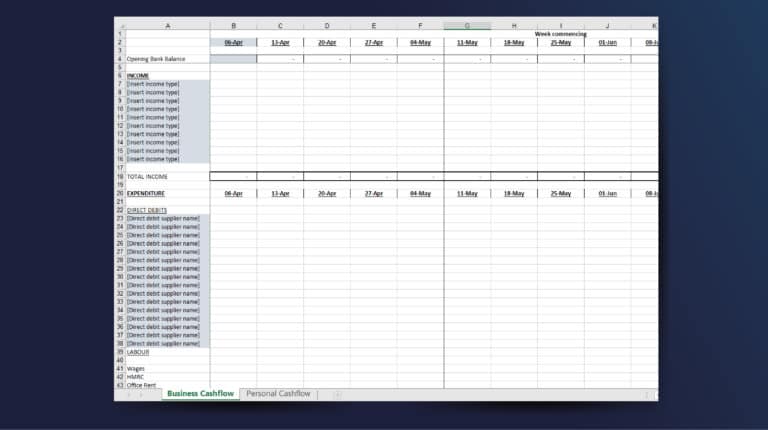

It is designed in such a way that it can be easily understood and implemented by anyone. The Daily Cash Flow Template helps you to keep track of your daily cash flow in a very simple manner. The template supports an unlimited number of transactions per month, so if your business requires more detail than this then you can simply change the number on line A4. It has all of the information that you need in one place and is designed so that it can be easily updated each day. If you are looking for a simple way to track your daily cash flow, this template will help. Track Your Excel Cash Flow Template Daily The daily cash flow forecast template helps you answer questions such as: How much do I need in order to stay afloat? What are my short-term goals? How much do I need in order to reach them? This allows you to track how much money is coming into the business and how much will be going out each day. The template can be easily customized so that you can enter in your monthly expenses, monthly sales revenue, cost of goods sold (COGS), and the resulting net profit or loss. The daily cash flow template is an Excel spreadsheet that's used to forecast the future of your business, and it's especially useful for those who run a small company. Monitoring and reviewing the cash deposits will improve the accuracy of the forecast. Monitor and review the Cash Flows Forecast Template on a daily basis in situations where cash management is a big essential part of company survival.Ī key component to focus on is the estimate of weekly cash deposits. Use the information on the report to help you manage cash for the day that you prepare it. Prepare the Daily Cash Flows Spreadsheet in the morning of each workday. If the company is in a severe cash crunch, you may need to negotiate with vendors about partial payments. Remember, this process should not take more than thirty minutes to prepare.

Free cash flow template update#

Update the Daily Cash Flows Template every day! Another symptom of a cash crunch is that accounting falls behind in processing information.īy preparing this Daily Cash Flows Projection or projection, you force the accounting department to stay current with posting transactions. It does not take into consideration outstanding checks. Though easy to do, this number is not accurate. When facing a cash crunch, CFO/Controllers often manage cash by reviewing the online bank balance.

You can then take the information generated in the daily cash flow template and incorporate the data into another useful tool, Financial model! Knowing your daily cash position gives you added impetus to collect money and/or to generate revenues. The daily cash flow template is used best as a tactical, active cash management tool.

0 kommentar(er)

0 kommentar(er)